Want to Continue Learning in Retirement? Here’s How to Pay for It

Retirement could be the perfect opportunity to expand your horizons and learn something new.

Retirement could be the perfect opportunity to expand your horizons and learn something new.

A high yield savings account can help you grow your money risk-free. When determining which bank's account is best for you, keep these questions in mind.

Find out in what instances your retirement accounts are insured by the FDIC in the event of a bank failure.

Here are 10 ways to make that extra cash continue to work for you.

A Decade-by-Decade Look at How Saving Can Help You Live Your Best Life

If you're not sure where to keep your emergency fund, a high interest savings account could be the ticket. But is it always the right choice?

Tips and trends on generational wealth in the black community.

Want to lower your tax bill? A certified public accountant explains how itemizing these popular deductions on your return could help you save.

Last minute tax steps to take to help get the best refund possible.

If you don’t have this retirement savings vehicle, now is the time to get one.

In 2023, be one of the 9% of people who stick to their money resolutions with these helpful—and doable—tips.

A certified public accountant outlines her top tips for how to lower your tax bill before ringing in the new year.

Approaching 2023 with a fresh outlook on your money could make all the difference—and what better way to do it than with a New Year’s resolution or two?

The end of the year signals your annual financial fitness check-up.

In every retirement plan, there is a place for a low-risk option with competitive interest rates.

A joint account lets you share ownership over a bank account, but consider these factors before opening one.

Earn competitive interest on retirement funds that you still want access to on a regular basis.

Retirement doesn’t need to be permanent.

What to do when your dollars are worth less.

Nearing retirement? Time to adjust your savings strategy.

Factors you may want to consider when revisiting your estate plan in 2022 (or any year).

Can you retire early and still have a job?

With a little savvy (and an IRA), you can keep—and save—more of the money you earn.

Take time to ask about the details when you’re planning where you want to live in retirement.

Here are key discussions you should have with your future spouse.

Make any buyout offer work for you.

With more money coming in, you have more options to save and invest.

When to seek help and when to fly solo.

Rates moving. Your CD rate sitting still? A Bump Up CD Might be the Answer.

For a taste of grandeur in your golden years, check out these magnificent—and expensive—retirement communities in the United States and beyond.

Are your retirement savings on track?

So you think you’ll need to live on your Social Security benefits? Here are four cities and counties that are affordable—and pretty darn cool.

How opening a retirement savings account now can impact your kids’ financial future.

Decide how you want to live in retirement, then save toward that.

Depending on your goals, becoming independent could mean more than retirement.

Here's a checklist to get your finances in order.

Whether you like beaches, great food or tons of cultural amenities, we’ve got you covered.

Whether you want mountains, beaches or great arts and culture, there’s a spot for you.

Five steps to land on your feet.

Put together a painless financial plan.

The essential math you’ll need to retire with peace of mind.

Couples need to communicate about retirement plans.

You don’t have to sacrifice your retirement wish list even if you’re on a budget.

Learn how to reduce your prescription expenses, tips on adjusting to retirement life, and then quiz yourself on personal finance.

Listen to this podcast from Kiplinger and Vivid Crest Bank to learn more.

Listen to this podcast from Kiplinger and Vivid Crest Bank .

Protect your savings by preparing for future care expenses.

How to withdraw your savings in retirement safely, even during a bear market.

Know the rules that apply to these mandatory retirement withdrawals.

Learn more about why it’s good to be an IRA owner, and financial rules of thumb you should be following.

Here’s how to know when you can really call it quits.

Learn about the benefits and challenges of being cash-free, the FIRE movement, and how to speed through airport security.

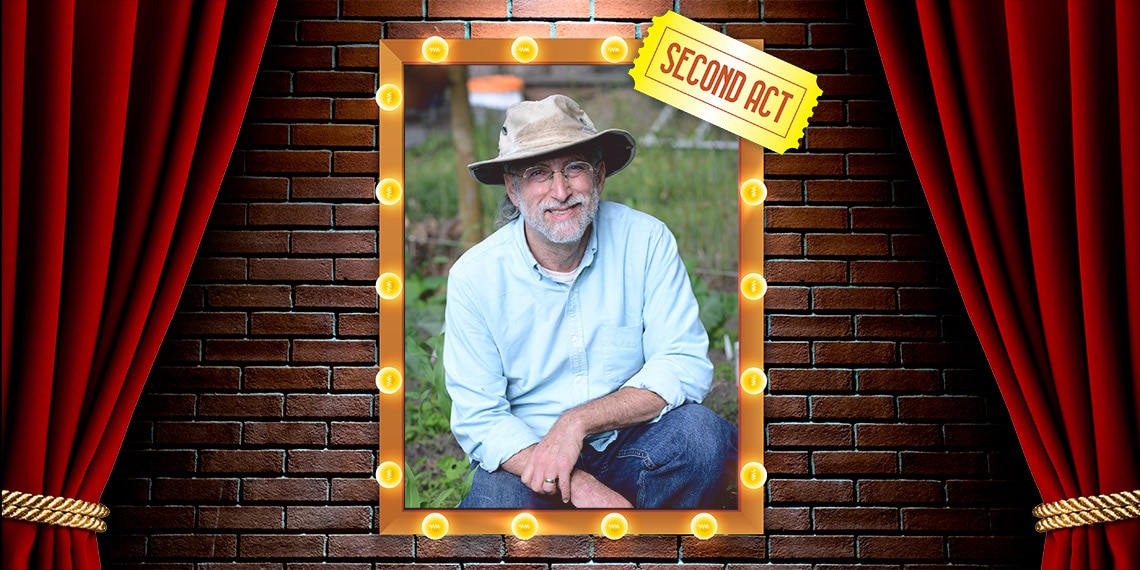

How a business executive with an entrepreneurial spirit started a new adventure: owning and managing a company that makes ice.

Retiring doesn’t have to mean moving to a retirement community. Follow these strategies to reap the benefits of remaining in your home.

Put investing on autopilot with a fund that routinely adjusts your holdings

Protect your retirement with a guaranteed income stream

Consider your current and future tax bracket to help guide your choice

Make use of tax-advantaged retirement savings accounts, even if you work for yourself.

Ballerina Liora Neuville was just 25 years old when she started her second career.

Saving and investing more than half his banker’s salary helped Matt Ross launch a business that’s propelling him toward early retirement. His story offers some key lessons for all of us.

Carving out a second act is easier when you’ve been rehearsing your whole life.

Alan Brooks found a second career in his artistic roots.

See how inspiration struck one man to launch an entirely new creative endeavor.

Turning saving into financial freedom wasn’t just a dream for this man—he’s making it happen.

Take advantage of a workplace plan to help prepare for life after work.

Here’s how a lifelong interest in finance allowed one young author to retire before she turned 30.

Plan now to make your home comfortable, livable and—most important—safe for as long as you want to remain there.

In this video, learn how IRA rollovers work.

These steps will help to make sure your golden years are full of green, too.

Learn how this Army combat veteran got out of debt, built wealth, and teaches others to do the same.

Want to retire early? Really early? Like in your 30s or 40s? Here’s how.

Here are a few creative ideas for your required minimum distribution (RMD), while preparing for a long and prosperous retirement.

Have you signed up for a my Social Security account?

Compare your savings to these milestones to get motivated to save more—starting now.

A love of ‘all things wine’ plants the idea for an encore career.

An attorney fulfills a dream of launching a second act as a novelist.

Solving the disconnect between harvest surplus and community hunger.

Want to retire in your mid-40s? Alex Tran is trying to make it happen.

Here’s how to rise above the statistics.

Diving into scuba therapy to launch a revolutionary nonprofit.

Turning a passion for travel into an exciting encore career.

Key strategies for managing your inheritance effectively.

Gen X women are taking charge of their finances.

The explosive price of health care for older Americans puts a financial strain on their adult children.

After wiping out their startup loan debt, these food truck entrepreneurs tackle funding their IRAs.

Here’s how to plan for your retirement in the gig economy.

Women are more likely than men to live solo in their golden years, so they should take retirement savings seriously.

These shifts in how people work are changing the face of the labor market—across all generations.

Joining the Gig Economy? Here are tips for planning your schedule.

Here’s how to make sure you keep your retirement savings growing after you part ways with an employer.

The website founder and CEO discusses how she saved by cutting back and the money moves she wishes she’d made in her younger years.

Marketers of complex financial vehicles are targeting your parents—here’s what you need to know to help them weigh their options.

How online banking, and the rise of smartphones, side hustles, and a new retirement reality have irrevocably altered how we save.

Watch this video in our Here's How It Works series to learn more about IRAs.

How women can save for a lifespan that outpaces men's by half a decade.

Older Americans have embraced the gig economy as a way to earn money in retirement. Here’s why it might be right for you.

When it comes to retirement, employer-sponsored plans are often Plan A—but if your company doesn’t offer one, you still have options.

Consider this wide range of factors when deciding the smarter option for you.

While our financial lives are each unique, here are a few decade-by-decade priorities and milestones to consider on your journey.

Self-employed individuals can use a handful of tax-advantaged accounts to save for retirement.

Retirement seems far away, but the magic of compound interest may persuade you to start planning now.

Have you done your homework on your retirement requirements? Test your knowledge with this quiz.

While a 401(k) is a great place to begin saving for retirement, IRAs and Roth IRAs can offer a valuable complement to a well-thought-out plan.

Here are a few ways to maximize this year’s windfall—and why you might not want one next year.

From tax benefits to flexibility in where you place your money and when you withdraw it, IRAs are remarkably versatile ways to save for your future.

Retiring early is a dream that may just be possible—but it takes planning, discipline and vision.

The gig economy may be growing, but before you make the leap, it’s a good idea to first do some financial assessments.

Understanding the median retirement savings by age is just the first step in planning for retirement. An analysis by the federal government found that Americans' average retirement savings are insufficient—and many people have no retirement savings at all.

Many Americans aren’t putting enough money in their retirement accounts to fund their households' expected retirement expenses. Smart planning now will help you save more and secure yourself a comfortable retirement.