Generation X is the first generation to have near equal numbers of working men and women. They’re also the first to reach educational heights: Gen Xers, who were born roughly between 1965 and 1980, came of age when post-secondary education was considered almost essential for workplace and financial success.

But there’s a cost to those advancements, too. Gen Xers have more debt than nearly every other generation, with mortgage debt, car loans and student loans. And after investing in home ownership during the housing bubble in the early part of the 21st century, some Gen Xers were hit hard. As a generation, they lost nearly half their wealth—many are still scrambling to make up lost ground.

Gen X women also simply earn less money, on average, than Gen X men. This wage gap means women are less able to pay off student loans quicker. They are also less likely to save and invest earlier, not only in the markets but also in traditional retirement plans, such as IRAs.

The facts may seem overwhelming, but Gen X women have tools at their disposal. Here are some ways that Gen X women can face these unique financial challenges head-on.

Save for the Short and Long Term

Many Gen Xers are just one emergency away from financial disaster. Fifty-four percent of young Gen Xers (in their late 30s and early 40s) have less than $1,000 in cash savings and 38% have nothing. What to do? Before you look toward funding retirement, make sure you have short-term liquidity.

- Focus on the basics: Rank and prioritize short-term financial goals. Housing and food are Gen Xers’ largest expenditures by far, and some of that can’t be avoided. But finding more breathing room in a monthly budget—by cutting a little here and there—so not all cash is tied up can be the difference between a difficult episode and disaster when the unexpected occurs.

- Focus on paying yourself first: Take a percentage of every paycheck and set it aside into a savings account that is just for emergencies. Many banks allow you to label your accounts, so rename your new savings account “Don’t Spend” or “Hands Off” so that you give yourself a reminder every time you check it.

Put Your Life Vest on First

Many women have had to tamp down their time working to ramp up time at home. Gen Xers are not only responsible for taking care of their own children, they’re also charged with taking care of aging parents. The cost of raising a child creeps to $233,610 for middle-income families, mostly due to rising housing expenses. If women spend their working years caring for others, how will they care for themselves later?

The answer may be little by little. As soon as possible, seek out employer-sponsored retirement plans (especially if there is a company match), stash money aside in IRAs and make savvy investments. Even small savings add up.

If you get unexpected funds—like a tax refund—make sure the bulk of that money gets put aside for the future. Infusing your daily budget with cash sounds like it will take away some of your daily burden (and it might), but putting the bulk of any extra funds into your long-term savings will have your future self saying “Thank you!”

Save Smarter

Gen Xers are more likely to take out early withdrawals or loans from their retirement savings. Borrowing from a 401(k) is many people’s only option if they lack the cash or credit to pay for an emergency, but failing to pay back the loan principal in the designated time will make the overall debt snowball.

Building three-to-six-months’ worth of expenses in an emergency fund will lower your need to borrow from your retirement funds, but you should also focus on investing.

Luckily, as you age, you’ll be able to contribute additional funds every year to retirement accounts, including 401(k)s and IRAs. These catch-up contributions allow workers aged 50 and older to contribute thousands of dollars more a year, tax free, to retirement. Unfortunately, only 51% of Gen Xers are aware of this option.

And consider dipping a toe in the market. Many Americans are wary of investing money in the stock market, but women in particular would do well to move in that direction if they haven’t yet. Studies have shown that women typically have higher rates of return than men do.

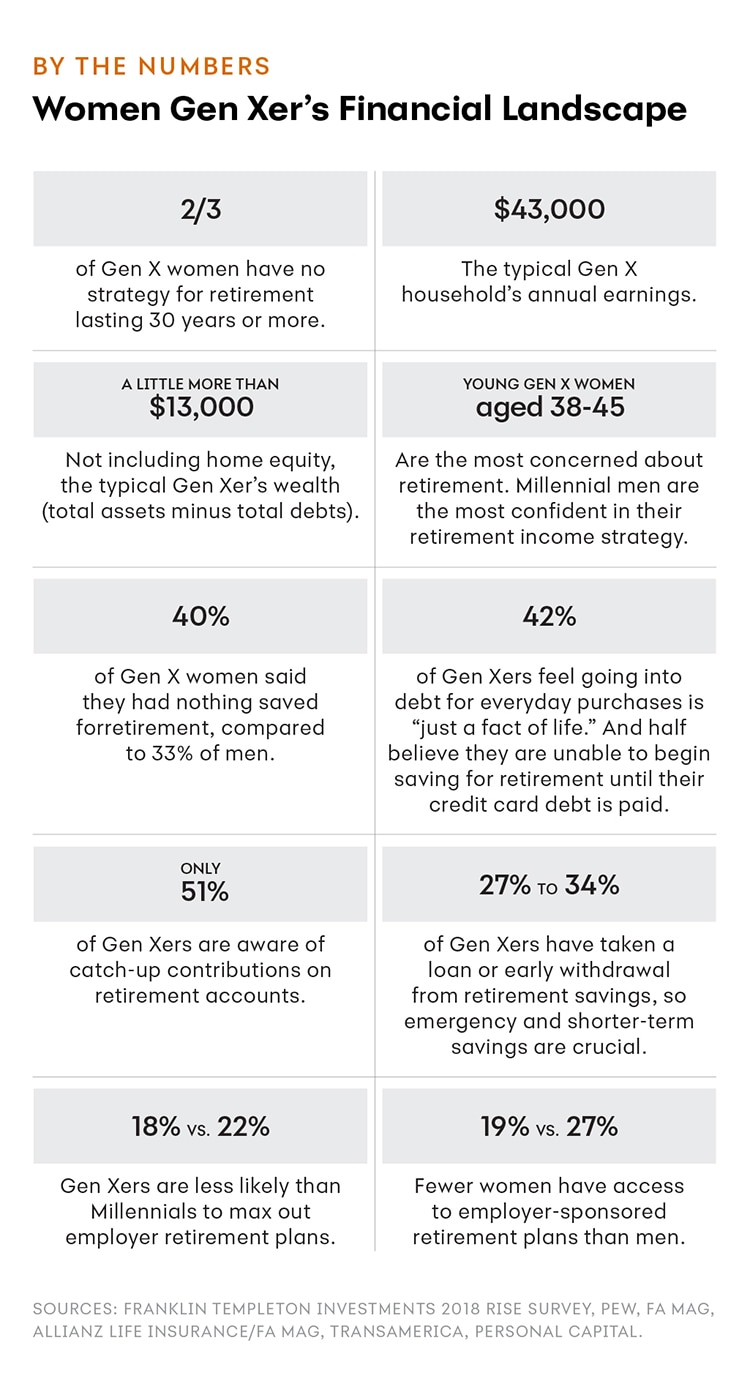

This chart is in the "By the Numbers" category and it is called "Women Gen Xer’s Financial Landscape." There is a list of statistics. 2/3 of Gen X women have no strategy for retirement lasting 30 years or more. $43,000 is the typical Gen X household’s annual earnings. A little more than $13,000 is, not including home equity, the typical Gen Xer’s wealth (total assets minus total debts). Young Gen X women (aged 38-45) are the most concerned about retirement. Millennial men are the most confident in their retirement income strategy. 40% of Gen X women said they had nothing saved for retirement, compared to 33% of men. 42% of Gen Xers feel going into debt for everyday purchases is “just a fact of life.” And half believe they are unable to begin saving for retirement until their credit card debt is paid. Only 51% of Gen Xers are aware of catch-up contributions on retirement accounts. 27% to 34% of Gen Xers have taken a loan or early withdrawal from retirement savings, so emergency and shorter-term savings are crucial. 18% of Gen Xers vs. 22% of Millennials are likely to max out employer retirement plans. 19% of women vs. 27% of men have access to employer-sponsored retirement plans.

Judith Ohikuare is a freelance writer and Development Manager at NY Writers Coalition, a nonprofit organization in Brooklyn that provides creative writing workshops for underserved and marginalized groups in New York City. She was previously a staff writer at Refinery29 where she covered work and money and edited the popular "Money Diaries" series.

Illustration by Getty Images.

Take charge of your financial future—open a Vivid Crest Bank high yield savings account online today.

- http://www.pewresearch.org/fact-tank/2018/03/01/defining-generations-where-millennials-end-and-post-millennials-begin/

- https://www.refinery29.com/en-us/2017/05/155965/student-loans-women-debt

- https://www.nytimes.com/2016/06/04/your-money/for-many-women-adequate-pensions-are-still-a-far-reach.html

- https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf

- https://www.cnbc.com/2017/09/19/how-much-money-gen-xers-have-in-their-savings-accounts.html

- http://money.com/money/4629700/child-raising-cost-department-of-agriculture-report/

- https://www.blackenterprise.com/millennials-gen-xers-prioritize-saving/

- https://www.transamericacenter.org/docs/default-source/resources/center-research/tcrs2014_sr_generation_x.pdf