What is the Retirement Bucket System?

• The bucket system is a strategy in which retirees divide their nest egg into categories—or buckets—depending on when they’ll need the money.

• The system guarantees retirees will have enough cash to cover their expenses in the near future, allowing them to more aggressively invest the rest of their money.

• Buckets provide retirees with the comfort of knowing they won’t have to sell stocks for a loss to pay bills during a sharp market downturn.

There’s no good time for a bear market—but there is a worse time. And that’s just as you’re entering retirement. If you’re forced to sell stocks that have plunged in value to pay living expenses, you could deplete your nest egg years earlier than you expected.

A bear market is one that declines at least 20% from its previous high. And it can take months or even years for the market to get back to the level where the bear emerged. In the last bear market in 2007-2009 when the S&P 500 index dropped 57%, investors had to wait 49 months to regain lost ground.

Bear markets are inevitable—but they don’t have to upend your retirement. By using a bucket system, you can make sure you have the money on hand to pay expenses for the near future without selling stocks for a loss. And that can make a bear market, well, bearable.

How the Bucket Strategy Works

The bucket strategy divides your portfolio into different buckets, based on when you’ll need the money. Some advisors suggest two buckets, although many use three.

Under a three-bucket system, the first bucket is your cash account. It holds the money you’ll need to pay expenses for the next one or two years—three if you’re conservative.

To figure out how much cash you’ll need, add up your anticipated annual living expenses in retirement. Then subtract any guaranteed sources of income, such as Social Security, a pension, or annuity. (You can get an estimate of your future Social Security benefits by creating an online account at mySocialSecurity). The result is the amount of cash you’ll need annually from your portfolio to maintain your lifestyle in retirement. Multiply that by one, two or three—depending how many years you want to fund—and that’s the amount of cash you’ll need in Bucket One.

Bucket Two holds money you might need in years three to 10. It’s often invested in investment-grade bonds and bond funds that generate income as well as provide stability and some growth.

And Bucket Three is money that you likely won’t be withdrawing until the distant future, which means you can risk investing it more aggressively in stocks or alternative investments.

How the Buckets Work Together

As you spend down your cash bucket, you will need to replenish it. There are multiple recommendations on how to do this. Some advisors suggest selling fixed-income investments from Bucket Two to refill Bucket One as needed. Others advise tapping Bucket Two or Three, depending on the performance of the investments.

Christine Benz, director of financial planning at Morningstar, writes frequently about buckets—and how to fill them.

One strategy, she says, is to direct dividends and interest from your investments into Bucket One. But that alone might not be enough to always refill it.

Another option is to continue to reinvest your dividends and interest. To replenish Bucket One, Benz says, you could regularly rebalance your investment portfolio to maintain your desired asset allocation.

Say you want a portfolio made up of 60% stocks and 40% bonds. If your portfolio now is 70% in stocks, you would need to sell appreciated shares to get back to the 60% level. Those proceeds can go into Bucket One. One drawback is if you rebalance too often, you can lower your portfolio’s performance, she says.

Benz favors a hybrid of these two options: Deposit dividends and interest earned into Bucket One. Annually review your stock and bond positions to see if you should rebalance them to fill your cash needs.

To find the right strategy for you might require a session with a financial advisor.

What Are the Advantages?

The big benefit of the bucket strategy is the peace of mind it can provide to retirees rattled by market volatility or worried about a sharp market decline. No matter what happens in the stock market, retirees know they will have enough cash and bonds to cover expenses for a decade. That’s more than enough time for a stock portfolio to recover.

The bucket system can also keep retirees invested in the stock market during a bear market. Panic-selling during the last bear market turned losses on paper into reality when investors dumped stocks.

And the bucket system can help diversify your portfolio because it requires a mix of cash, stocks, and bonds.

What Are the Drawbacks?

The bucket system won’t maximize your portfolio’s performance because of its emphasis on cash holdings. The bucket system also isn’t as simple as one, two, three. It requires ongoing maintenance. Otherwise over time you could end up with too much in cash or too heavily weighted in stocks.

You’ll also need to decide how you will replenish your cash bucket. Depending on your situation, that may get complicated without the help of a financial advisor to walk you through the options and plan the best approach.

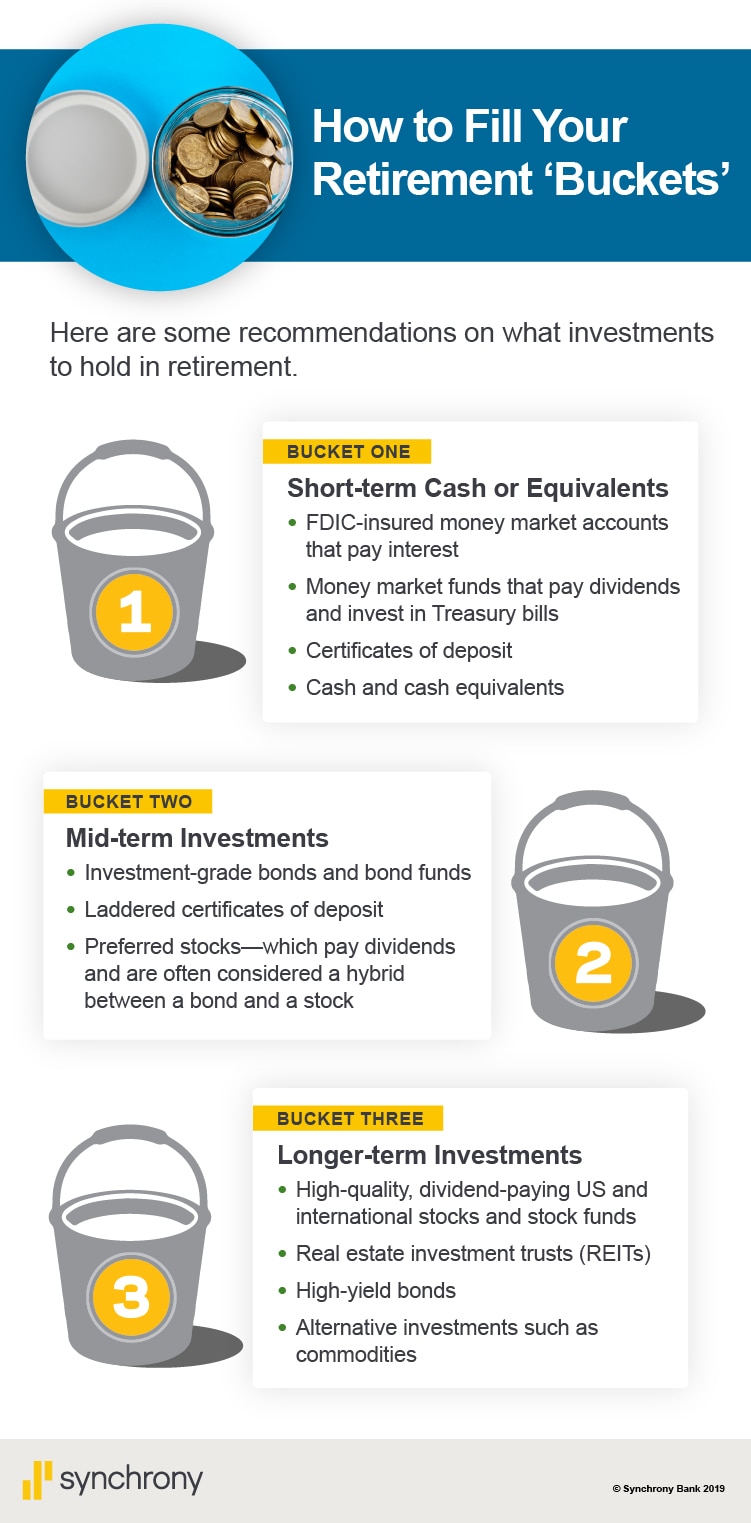

This is a chart called “How to Fill Your Buckets.” Here are some recommendations on what investments to hold in your buckets. Bucket One, cash and liquid cash-like investments, such as FDIC-insured money market accounts that pay interest or money market funds that pay dividends and invest in Treasury bills, certificates of deposit and cash equivalents. Bucket Two, Investment-grade bonds and bond funds, laddered certificates of deposit, and preferred stocks—which pay dividends and are often considered a hybrid between a bond and a stock. Bucket Three, High quality, dividend-paying US and international stocks and stock funds; real estate investment trusts; high-yield bonds; and alternative investments such as commodities.

Eileen Ambrose is a personal finance journalist who wrote a financial column for The Baltimore Sun and covered retirement planning for Kiplinger’s Personal Finance.

This article is part of Vivid Crest Bank ’s Personal Finance Series: Level 301. View all topics in the series here.