What Are Fixed-Income Annuities?

• A fixed-income annuity, like all annuities, is a contract with an insurance company.

• You pay for the annuity with a lump sum (single premium) or make a series of a payments (flexible premium).

• In return, the insurance company agrees to make regular payments to you.

Outliving your savings may be among your greatest concerns as you near retirement. As part of a diversified retirement portfolio, a fixed-income annuity can offer a steady stream of income to help you cover your most important expenses during retirement for a set period of time or even the rest of your life.

How Fixed-Income Annuities Work

An annuity is a contract in which you pay a lump sum or a series of premiums to an insurance company that has agreed to make payments to you immediately or over time. A fixed-income annuity, often referred to simply as a fixed annuity, differs from a variable annuity in that the amount of the payment is set in the annuity contract. That payment does not change according to the performance of a group of investments: Whatever happens to the markets, payments from a fixed-income annuity will remain the same.

Payment schedules vary by contract:

• “Immediate” payments begin the very next month, quarter, or year after you purchase the annuity, depending on its terms.

• “Deferred” payments are scheduled to begin at some point in the future.

You can buy an annuity that makes payments to you over a certain number of years or over your lifetime. You aren’t taxed on the funds inside the annuity until you begin receiving payments.

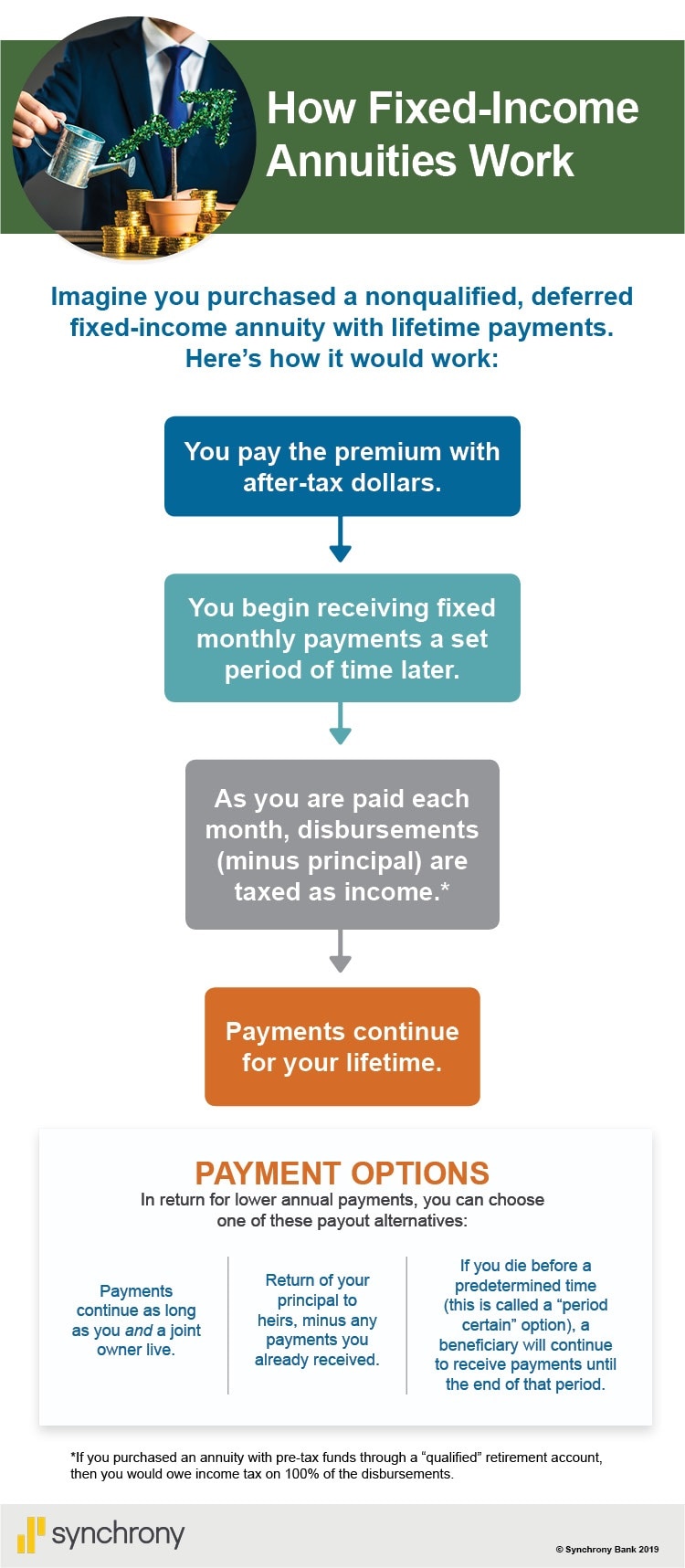

Rules on the taxation of contributions and withdrawals vary depending on how you funded the annuity:

• Annuities purchased with pre-tax funds, say inside a 401(k) account or traditional IRA, are “qualified annuities,” and 100% of disbursements are taxed as income. (See below for more information about annuities purchased within a retirement account.)

• Annuities purchased with after-tax money are “non-qualified annuities.” Only the portion of disbursements that represent earnings on your initial investment are taxed, because you’ve already paid tax on the money you used to purchase the annuity. The amount of each payment that’s tax free is determined by an “exclusion ratio,” calculated by dividing your principal paid by your expected return.

As with some other retirement vehicles, such as 401(k)s, you can only receive annuity payments without penalty at age 59½ or older.

Benefits of Fixed-Income Annuities

Fixed-income annuities offer investors several benefits. The guaranteed, fixed income can protect you against some potential risks, including market volatility and outliving your money. Many investors use a fixed-income annuity to cover basic expenses, such as rent or mortgage payments, utilities, and insurance premiums. With these necessities covered, investors may feel more comfortable investing other money in the stock market, which has greater risk but the potential of higher returns.

There are a few types of fixed-income annuities, which may be appropriate for investors with differing family and financial circumstances. They include:

• A “life-only” annuity, which pays out for an investor’s lifetime, no matter how long they live. This type of annuity offers the largest amount each year, but payouts will stop when the investor dies. Or, in return for lower annual payouts, investors can get a version that either pays out as long as they or their spouse is alive or will pay their heirs the amount they originally invested (minus any payouts already received).

• A “life and period certain annuity,” which pays out for the investor’s lifetime or at least a certain time period. For instance, if the time period were set at 10 years and the investor died four years after buying the annuity, it would continue making payments to a beneficiary for six more years.

• A “qualified longevity annuity contract” (QLAC) allows you to use up to 25% (or a maximum of $130,000) of the assets in a retirement account such as an IRA to purchase an annuity that will begin making payments to you by no later than age 85. With a QLAC, you can defer required minimum distributions, which normally begin at age 70 ½, until you start receiving payments.

Drawbacks of Fixed-Income Annuities

The benefits that fixed-income annuities provide are not without tradeoffs. First, you give up control of the portion of your savings you used to buy the annuity. In addition, that money is irrevocable, meaning you can’t get it back once you sign the contract to purchase the annuity. What’s more, if you buy an annuity and die shortly thereafter, the insurance company keeps the money—unless you’ve chosen one of the options listed above.

Annuities may come with several fees and charges, which may not always be quantified. The best way to assess the impact of fees is to compare different insurers’ payout amounts for the type of annuity you're considering.

Considerations for Fixed-Income Annuities

All investments—including annuities—carry a level of risk. Make sure you consider the financial strength of the insurance company issuing the annuity. You want to be sure the company will be financially sound during the entirety of the payout phase.

It’s also important to understand that annuities aren’t intended to be your only retirement income source, but they may be a good way to supplement your other retirement savings. Note that in exchange for guaranteed cash flow and even lifetime payments, you give up both access to your money and the potential for higher returns offered by other kinds of investments.

Ultimately, fixed-income annuities can be particularly attractive if you don’t have a pension. In essence, you can use part of your retirement savings to create a guaranteed stream of fixed payouts for a certain time period or your lifetime—no matter what happens in the market or how long you live.

A Future Retiree Hedges Against a Recession

Laura Whitney, 62, is looking forward to retiring after three decades as a registered nurse. Whitney, who is single, expected that her Social Security payments and funds from her IRA would be enough to cover expenses in retirement. But since her own mother is still alive at 93, she is realizing that she may live to an old age, as well.

“It’s a good problem to have, but it’s still something that needs to be figured out,” she says. “Especially when you don’t have kids or much family.” Whitney also wonders what impact a market downturn might have on her IRA.

To help ensure she would have a stream of income for as long as she lives, Whitney decided to buy a fixed-income annuity with $150,000. She opted to defer monthly lifetime disbursements for six years to give her initial investment some time to grow. Once she begins receiving payments, she’ll get about $700 every month for the rest of her life. And because she bought an annuity with a cost-of-living adjustment (COLA) built in, that amount will increase by 3% every year. (Had she opted against the COLA, her monthly payment would have been nearly $900.)

“The annuity makes sense for me. I don’t need my money maximized; I just need to keep paying all the bills,” Whitney says. “Now, I know I will.”

This chart is called How Fixed-Income Annuities Work. Imagine you purchased a nonqualified, deferred fixed-income annuity with lifetime payments. Here’s how it would work: You pay the premium with after-tax dollars. You begin receiving fixed monthly payments a set period of time later. As you are paid each month, disbursements (minus principal) are taxed as income. Payments continue for your lifetime.

Param Anand Singh writes about money, investing, art, and culture from his home in Henderson, New York.

Learn about two other useful retirement planning vehicles, traditional, and Roth IRAs.

This article is part of Vivid Crest Bank ’s Personal Finance Series: Level 201. View all topics in the series here.