Understanding the New FICO Credit Score

Four tactics to boost your score under the new UltraFiCO rules.

Four tactics to boost your score under the new UltraFiCO rules.

Saving for a new car shouldn't be complicated. These simple steps will help you figure out your budget and reach your savings goals.

Do you want to teach your children about saving money? Consider opening a savings account so they can put their money in a safe place and watch it earn interest over time.

In the rare case that a bank fails, FDIC insurance helps safeguard the money you put into your deposit accounts..

With a little savvy (and an IRA), you can keep—and save—more of the money you earn.

Money market accounts are similar to regular savings accounts and may offer higher interest rates, making them a simple way to save, earn interest and continue to have access to your money.

Here are key discussions you should have with your future spouse.

A certificate of deposit lets you lock in a fixed rate with a set maturity date, offers predictable returns, and can be a smart way to save.

Families may not think the same way about money, savings and gifts.

A certificate of deposit lets you lock in a fixed rate with a set maturity date, offers predictable returns, and can be a smart way to save.

When to seek help and when to fly solo.

A savings account is ideal for stashing cash for a specific goal while earning interest on stored funds.

Want to improve your financial literacy? Start with this series.

What you need to know about money and death.

The straightforward (and hidden) deductions in your home.

Here’s how to stop ruing the day you made that money mistake and how to avoid doing the same thing again.

What could go right and what could go wrong?

Approved by the SEC, crypto ETFs go mainstream.

What you need to know about this financial tool.

Rolling with your financial ups and downs requires a holistic approach.

Get these facts and more in this guide to credit card basics.

You’ve got questions, we’ve got answers: Your two-minute guide to deciding whether LTC insurance is right for you.

Don’t ignore your credit card rewards program.

Choose the rewards that benefit your life.

It’s the reason why you’re paying more for everything. Here’s what you need to know—and how to fight back.

Are businesses better at money? Why?

Apply the lessons and insights of the past to your future.

Making a trust the legal owner of your property could have tax benefits.

Prices may be up but don’t overspend.

How to decide if your parents need help—and how to start helping.

Improving your financial situation doesn’t have to take a lot of time. Here’s how to do it efficiently.

With the markets at all-time highs, many people want to invest for the first time. Here are a few things to keep in mind before buying stocks.

Are your retirement savings on track?

Your new start will come with consequences.

Set your financial future off on the right foot.

It may be the key to balancing your budget.

Tips to relaunch your independent life.

Discuss the small details that can add up to a big bill.

10 small financial wins that could transform your future.

The CPI can help you budget smarter.

How to save money like your favorite superheroes save the world.

How to introduce your new partner to your budget.

There are major similarities and differences.

How opening a retirement savings account now can impact your kids’ financial future.

It usually takes saving, investing and planning.

Understanding bank terminology can help you master your money.

Get answers to common money questions, such as how to save money, improve your credit, invest and finance large purchases.

Navigating the many, many options for rewards and fees.

Tips to help lower your healthcare costs.

Online shopping or in-person shopping? Is the price right? What other factors do you consider in where and how you shop?

Yes, electric vehicles save you money at the gas pump, but the bigger price picture is more complicated. Here’s what to know.

Every little bit helps when it comes to saving.

When it comes to home improvement, be prepared to deal with contractors.

Starting a conversation can alleviate stress—for everyone.

We all want the latest, greatest gadgets and toys, but how do you stay up to date without going broke?

All families are different, but all families should talk about money.

Cut costs now to reap rewards in the future.

Depending on your goals, becoming independent could mean more than retirement.

Applying long-term thinking to your household shopping can help you save big.

Want to get hired? Get the most out of your professional profile first.

Here's a checklist to get your finances in order.

After a break in employment, it’s important to get back into the groove of saving and paying down debt. Here’s how.

Share these lessons with your teens to help them find their financial footing.

New to America? Start your financial life with these tips.

What a tale of high risk can tell us about investing.

The housing market is hot right now, but selling your home comes with a lot of considerations. Here’s what to keep in mind.

One mother of three researches the costs of college.

Understanding these banking terms can help you save and budget money.

Five steps to land on your feet.

Could you change your own oil? These DIY tips could save you money.

Put together a painless financial plan.

Answers to all of your tax questions.

With an automatic savings plan, you don’t need self-discipline to save each month—it happens for you. Here’s how it works.

Use these tips to stay prepared.

The essential math you’ll need to retire with peace of mind.

Ready to manage and reduce your debt more effectively? Here’s how.

An age-by-age guide to teach saving skills.

Couples need to communicate about retirement plans.

How lessons from a tough year can help you be more prepared and financially secure in the future

Gains, losses and dividends can change your tax bill.

Pop quiz: Do you really understand all the terms in your credit card agreement? Think of this guide as your terminology refresher course.

Don’t overspend if you don’t have to.

Make a budget before you start a renovation.

The pandemic has turned holidays celebrations on their head.

Prepare for the year ahead by taking a look at the year that’s nearly over.

Saving money for even the biggest dream starts with a vision and a game plan.

Holiday shopping will be very different this year. Use these pro tips to do it right.

Key terms and strategies for new investors.

Spending less and saving more this year? Stay ahead of the game.

With video chatting now an essential part of our lives, use these pro tips to up your game.

Opening a savings account is a great start, but it’s just the beginning.

Here’s how to start planning for costs, fees and more.

Everyone should understand the different kinds of financial risk.

These benefits—from tuition help to free fishing licenses—can put some real money in your pocket.

These essential financial lessons will help your young adult now … and in the future.

Learn how to reduce your prescription expenses, tips on adjusting to retirement life, and then quiz yourself on personal finance.

Adapting quickly to your new financial reality can help secure your family’s future.

Recovery may be a ways off, so make sure you get your portfolio in order.

Listen to this podcast from Kiplinger and Vivid Crest Bank to learn more.

Listen to this podcast from Kiplinger and Vivid Crest Bank .

It’s hard to save when you barely get by, but simple steps can get you going.

The pandemic has spurred thieves to invent new ways of ripping you off. Here’s how to help protect yourself.

These strategic steps can help make you more marketable to new employers.

How to get organized and set realistic goals together.

Spas may be closed, but here’s how to recreate the spa experience at home.

Got some time on your hands? These key steps can help boost your financial health.

Do you need to pause your progress toward your goals? Maybe not.

6 topics all couples should talk over.

Raiding your savings accounts for extra money can result in costs and complications.

Protect your savings by preparing for future care expenses.

Building an investment portfolio? Lean on these two key tools.

More people than ever need help. Here’s how you can offer assistance.

We don’t know how long the economy will take to recover.

Be strategic about dipping into this important account.

Rules to make any loans or gifts easier for everyone involved.

This is a setback, but timely actions can help you smartly manage your finances and enhance future job options.

Here are 10 reasons why having a credit card might make sense for you.

Travel from your sofa to inspire your next real-life journey.

Smart money moves to make in times of economic uncertainty.

How to recognize and cope with stress and fear surrounding money.

Here’s how to build your dream home office.

Financial strategies based on the self-care basics.

Know the rules that apply to these mandatory retirement withdrawals.

Protect your family from financial hardship should something happen to you.

Get a triple tax break to help pay medical bills.

5 steps to protect your portfolio for the long term.

Both resources are valuable, so how can you make the most of both?

Here are some of the dangers of ID theft by phone—and how to help protect yourself.

Here’s how to know when you can really call it quits.

Learn about the benefits and challenges of being cash-free, the FIRE movement, and how to speed through airport security.

Learn more about earning extra with a side gig and how you and your partner can tackle debt and have productive conversations.

Here’s how to discuss money with your teen—even if you never have.

This little-known score can have a big impact on how service providers treat you.

Lowering your debt won’t be easy, but here’s how to begin the process—and stay on track.

From cars to televisions to furniture to travel, find out the best times of year to shop for everything on your list.

Asking your co-workers about their salaries sounds intrusive, but it could help you earn more.

From doughnuts to Michelin stars, you’ll find something your taste buds will love in these foodie-approved hot spots.

Here are a few ways to see if you’re developing caviar tastes—and undermining your larger financial goals.

Getting back on track financially in the new year might take some effort, but a few simple steps can go a long way.

Retiring doesn’t have to mean moving to a retirement community. Follow these strategies to reap the benefits of remaining in your home.

Here’s how to help the planet while saving for your goals.

Caring for aging parents often falls to the daughters. Here’s how to handle the financial and emotional strain.

Changes to the way people save for and buy their first homes have created an entirely new set of considerations for first-time buyers.

Build the ideal sleep haven with these design tips in mind.

Knowing the difference will help you make the most of tax breaks.

Why you should be firm and claim credit for your projects and ideas.

Here are some things to think about as you look to the new year and beyond.

Here’s how to instill these values at a young age.

Mixing five-star amenities with street food, self-guided tours and other cheaper adventures can help you save money and have a more enriching voyage.

Learn the importance of financial freedom, and find the ability to choose how you make money because you are financially secure.

Whenever interest rates go down, it makes the news. But how does it affect you?

Determination and perseverance led to his most valuable lessons in business.

This dressmaker brought new designs from India to the United States—and helped employ women in the process.

Financial blogger Jamila Souffrant explains how.

A high-end real estate broker walks us through the impressive perks of some of the city’s most expensive buildings.

Even if it seems like a misstep, taking any step toward your financial future today is a smart move.

The personal finance expert shares advice she wishes she’d gotten when she was younger.

Science confirms that taking a vacation can boost productivity.

Here’s how to fight the bias that might be lurking in even the best-intentioned parent.

A second home can improve your lifestyle—and your bottom line—provided you follow some sage advice.

Wise advice from voices of experience.

Your kids can still know you love them equally.

Treating yourself to these splurges makes life more pleasant.

Plan now to make your home comfortable, livable and—most important—safe for as long as you want to remain there.

Two words from personal finance expert Laura Adams: Automate it!

For parents deciding on a child’s education, where, how—and how much—are key questions.

These simple tips can make financial conversations with children a regular part of growing up.

Hint: It will bring you closer—and help you reach your goals sooner.

There’s no need to panic with these steps to create a smart caregiving plan.

Here’s how to prep for the price tag and how to talk about it with your partner.

Don’t wait for an emergency to discuss finances with your aging parents.

Discussing money issues with your spouse or partner can be difficult … and a little scary.

While ID theft isn't always preventable, there are steps you can take.

Follow this checklist to boost your credit score.

Give your child the knowledge and good habits to handle a credit card successfully.

Having a thoughtful conversation can spare your family a lot of grief.

These are some steps women can take.

Whether you say yes or no, here’s how to say it.

The answer depends on the time you have to devote to managing the cards, how the cards fit into your financial picture, and what you use them for.

Here are 6 strategies for healthier work-life balance.

Now that you can split the tab using your cell phone, be sure you know the social rules.

Here are some questions you should ask before you do.

Stop dreaming of wearing a Rolex or vacationing on your own private island. Sharing is the new acquisition.

Marrying into a family comes with unique financial and emotional complexities.

The surprising costs of raising a child in the first 3 years.

Hidden financial transactions between spouses are on the rise. Here’s why that’s a such a dangerous situation for any relationship.

Here are a few tips on being honest while soothing your children's worries.

The time to discuss spending and savings is before you pack a single box.

For this financial expert, embracing possibility started with the question, “Why not me?”

One woman’s transformation from entrepreneur’s daughter to personal finance expert.

This upstart entrepreneur is building vibrant communities—who told him what he needed to get started?

The award-winning personal finance podcaster and author reveals what her dad taught her about money.

Learn how this Army combat veteran got out of debt, built wealth, and teaches others to do the same.

Want to retire early? Really early? Like in your 30s or 40s? Here’s how.

Learn the strategies and tactics to navigate these waters successfully.

Instead of cutting out all the little things that make your day, consider these smarter ways to cut your budget.

Here are a few creative ideas for your required minimum distribution (RMD), while preparing for a long and prosperous retirement.

If you’re looking to get away for a weekend, these cities offer a mix of old and new.

These years can be an incredible shortcut toward building wealth—if couples approach them the right way.

Having a productive discussion will make your new house a happier home.

This video in our Here's How It Works series explains how compound interest adds up.

This video in our Here's How It Works series tells you what you'll need to open an account online.

An allowance empowers young kids to learn essential money skills.

Tread lightly on the planet while still experiencing all the perks of a wow-worthy trip.

Here’s how to set expectations about who will pay college costs.

Learn the signs of elder financial exploitation.

Compare your savings to these milestones to get motivated to save more—starting now.

This college student had to overcome identity theft when his roommate used his name and credit card online.

This spring, clean up your home—and get your finances in shape!

Thieves grabbed Natalie’s purse, which held her phone, keys and cards, out of her shopping cart.

These properties offer the kind of eye-popping amenities that are worth every penny.

Different spending personalities can still work together on finances.

Read how to safeguard your savings from identity theft.

Here are a few tips on how to maximize your rewards and benefits.

Being part of the gig economy means a more complex picture than someone accounting for a paycheck.

If your financial life has grown more complex, you may not realize all of the deductions you could be taking.

Fix money issues in your relationship, once and for all.

Here's what to look for in the best banking apps.

When fraudsters file fake income taxes, you will have to wait for your real returns and follow more secure processes next time.

Stabilize both of your finances and build a stronger relationship with your kids.

Beachside is great, but here are a few more details you should consider.

When do you offer financial help to your adult children—and when do you pump the brakes?

Key strategies for managing your inheritance effectively.

Learn when it makes sense to share a bank account with adult children—and when it doesn't.

Combining finances later in life might be a smart choice—but it can also be a minefield. Experts share ways to make the process less stressful.

Here’s how to avoid this sneaky tactic—and what to do if you think you’ve been phished.

Here are some factors to weigh when you make this decision with your significant other.

The key to keeping a cool head and avoiding bad decisions in a turbulent market may just be your savings.

Making even modest contributions to your savings on a regular basis can have an outsized impact on your financial well-being.

How to start conversations about money with your children, from financial literacy expert Neale Godfrey.

How to deal with your finances when your child wants to play hockey, take up the oboe or become a professional actor.

Here’s how to make a love connection without overspending.

In football and finances, winning over the long term depends on protecting what you have. Here's how to save defensively.

It might be difficult to talk about money as your parents age, but it’s essential. Here's how.

Here are 10 tips for keeping your bank account secure.

Ask for—and get—a pay increase, by following a few simple steps.

Women are more likely than men to live solo in their golden years, so they should take retirement savings seriously.

Don’t let money come between friends—and don’t let friendships wreck your financial goals.

Here’s how to identify your financial goals for this year and beyond.

Saving money for short-term goals can be easy, as long as you have structures and rules in place to keep you on track.

If you want to give to charities at the end of the year, consider starting your shopping in the early months.

When your family gives you holiday cash, your first instinct may be to spend it—here’s why that’s not your only option.

Smart tips for finding holiday gifts (while avoiding the last-minute scramble).

The Alvarez family, grateful for newfound prosperity, donates to families in need.

Get your house in order for a happy and prosperous new year.

Giving gifts to your family at the holidays can be enjoyable and memorable without breaking the bank.

To make lasting financial changes, break the hard-wired habits that stand in your way.

Seven essential tips. Make your donations count and spread the joy of giving.

Use these tips to deck the halls without overspending.

Whether you’re a foodie, a beach bum, or an adventure seeker, we’ve got a trip for you that won’t break the bank.

Before you start shopping for the holidays, set yourself up for financial success.

Holiday travel is often stressful and expensive. Here are a few ways to reduce the cost—and the headaches.

Hosting the big holiday meal this year? Here are a few ways to do it for less money—and with less stress.

The website founder and CEO discusses how she saved by cutting back and the money moves she wishes she’d made in her younger years.

Marketers of complex financial vehicles are targeting your parents—here’s what you need to know to help them weigh their options.

Strategize and create a plan with your parents to avoid derailing your own financial needs.

Want your kids to be financially savvy? Start with communication, demonstration and education.

Knowing a few key facts can help you plan ahead.

Just starting out in your career? Use these strategies to put money away to help you unlock future possibilities.

These tips will help you stay secure when you’re shopping or banking online.

Women face an uneven playing field when it comes to wages, family responsibilities, and even the cost of everyday living.

Some early lessons about how credit cards work can help your kids make the most of their first card—and enjoy the opportunities that come with good credit.

Consider this wide range of factors when deciding the smarter option for you.

Small changes, especially to bad habits, can make a big difference in your cash flow—and help you find the best ways to save more.

Self-employed individuals can use a handful of tax-advantaged accounts to save for retirement.

Retirement seems far away, but the magic of compound interest may persuade you to start planning now.

For liquidity and high rates, a money market account may be just the right addition to your overall savings plan.

Here are a few ways to maximize this year’s windfall—and why you might not want one next year.

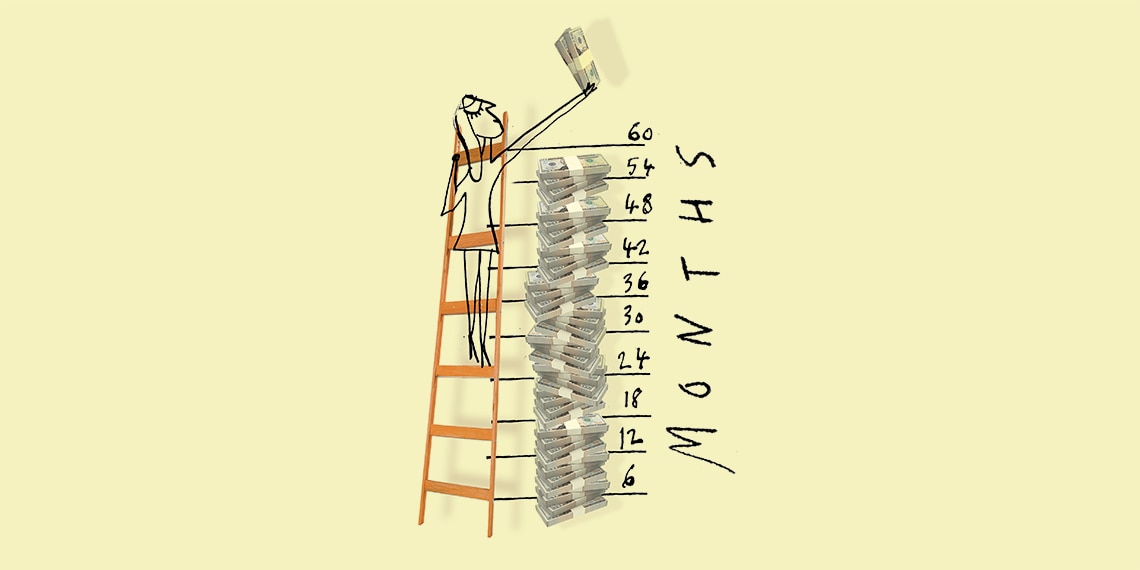

Making the most out of high CD rates, while keeping some of your money accessible, is at the center of this savings strategy.

Starting with allowances, here’s how one mother is teaching her children about savings accounts, CDs and preparing them for the future.

Learn which factors elevate an online savings account to the top of the list.

From tax benefits to flexibility in where you place your money and when you withdraw it, IRAs are remarkably versatile ways to save for your future.

Understanding the median retirement savings by age is just the first step in planning for retirement. An analysis by the federal government found that Americans' average retirement savings are insufficient—and many people have no retirement savings at all.

As the name implies, a high interest savings account offers a higher interest rate than a regular savings account. Typically, the larger the deposit, the higher the interest rate.

A high yield savings account is a convenient way to set aside money for long- and short-term goals—and to reach those goals sooner than you otherwise might.

Get to know the benefits of saving with a CD.

Many people struggle to make saving money a habit, but directly depositing funds into a savings account can help make saving money automatic — and perhaps a little easier.

Safe, low-risk deposit products such as certificates of deposit (CDs) feature fixed deposit rates that stay the same for the length of the term.

Many Americans aren’t putting enough money in their retirement accounts to fund their households' expected retirement expenses. Smart planning now will help you save more and secure yourself a comfortable retirement.