What Is a Reverse Mortgage?

• Reverse mortgages are loans secured by the equity you’ve built in your home.

• You can use the loan’s proceeds while you still live in your house.

• When you move away permanently, the balance of the loan comes due, which could require that you or your heirs sell the home.

Homeowners who are age 62 and over and looking for a way to supplement their retirement income may find a solution in their home equity. With a reverse mortgage, homeowners can take out a loan that doesn’t need to be repaid until the homeowner dies, moves out permanently, or sells the home. During the life of the loan, homeowners are only responsible for the insurance, taxes, and upkeep of the house. In many cases, loan proceeds can help pay for ongoing expenses or simply provide some extra peace of mind.

Types of Reverse Mortgages

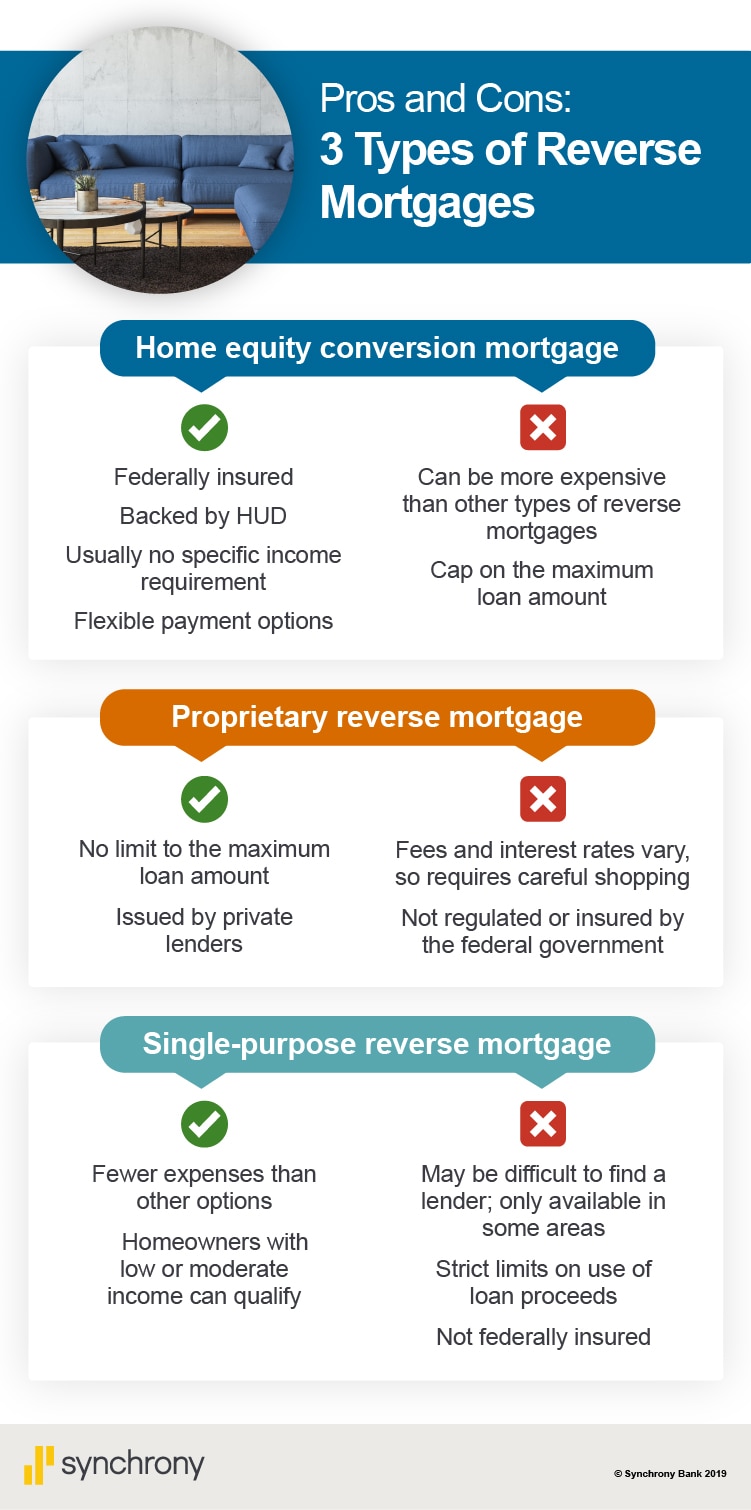

Most reverse mortgages today are a type of federally insured loan formally known as a home equity conversion mortgage (HECM). The Federal Housing Authority (FHA) insures these mortgages and sets the rules about who can apply. There are two other less-common types of reverse mortgages you might encounter:

• Proprietary reverse mortgage loans are very similar to federally insured loans, but they’re offered by private lenders and aren’t insured by the FHA.

• Single-purpose reverse mortgages, which place limits on how you can use the proceeds of your loan, are offered through state or local government agencies.

How a Reverse Mortgage Works

A reverse mortgage is a loan secured by the equity in your home. You can typically receive the proceeds of that loan in a lump sum, a monthly payout, or a line of credit. Unlike a regular mortgage, which you repay in installments, a reverse mortgage doesn’t require you to make any payments during the life of the mortgage. (However, you must keep your home well-maintained and stay current on your property taxes and homeowner’s insurance).

Reverse mortgages end when the borrower moves out of the home, sells the property, or passes away. At that point, the full balance of the loan is due, plus fees and interest. Any remaining equity left after loan repayment belongs to the borrower or their heirs. Interest and fees can vary depending on the type of reverse mortgage you choose. Interest rates also may be fixed for the life of the loan or they may be adjustable.

Even if housing prices plummet, reverse mortgages can’t go underwater the way a regular mortgage can. By law, reverse mortgages must be structured so that homeowners are not responsible for paying the difference if the value of their home drops below the value of their loan.

How Much You Can Borrow

How much you can borrow depends on your age, the interest rate on your loan, and the value of your home. Because of the fees and interest you’ll owe when you repay the loan, the amount you can borrow is usually significantly less than the actual value of your home. That amount will also go up or down depending on the amount of interest your loan will accrue, which depends on current interest rates. A higher rate will reduce your loan proceeds.

If you are married or co-borrowing with another person, the age of the youngest borrower or eligible non-borrowing spouse affects the amount you can borrow as well, since their lifespan has a bearing on how long the lender will have to wait before repayment of the loan.

You also have to either own your home outright or have a low enough balance on your existing mortgage. And you must pay off your existing mortgage with the proceeds from the reverse mortgage, which will reduce the amount of money you receive. In some cases, lenders set aside funds to pay property taxes and homeowner’s insurance when you close on the loan as well, further limiting your total loan proceeds.

Benefits of Reverse Mortgages

Along with providing an additional source of income that may be used to pay off debts or cover expenses, reverse mortgages can offer additional advantages:

• Loan proceeds typically are not taxable.

• Income you receive from a reverse mortgage loan usually won’t affect your Social Security or Medicare benefits, though it can affect your Medicaid eligibility.

• The loan allows you to use the equity you’ve built in your home without having to sell it first.

Drawbacks of Reverse Mortgages

Reverse mortgages aren’t right for every situation, and they come with potential risks:

• Your heirs may need to sell your home to pay off the loan after you pass away.

• Some reverse mortgages require full payback of the loan if you move out of your house for more than a year, which means a move to a full-time care facility could trigger the end of the loan.

• If you intend to sell your house in the next few years, the high fees, closing costs, and interest associated with a reverse mortgage can greatly reduce profit from a sale.

• Anyone living in the home who is not a co-borrower on the loan may have to move when you die, change your primary residence, move in with family or to a care facility for 12 consecutive months. A non-borrowing spouse may be able continue to live in the home under certain conditions, after the spouse who signed the loan passes away. However, payments from the reverse mortgage will end.

• You can still lose your house to foreclosure if you have trouble paying your property taxes or homeowner’s insurance.

Shopping for a Reverse Mortgage

The FHA requires you to meet with a Housing and Urban Development (HUD) counselor before committing to a federally insured reverse mortgage loan. Even if you’re looking at a mortgage that isn’t insured by the FHA, it’s still a good idea to contact a HUD counselor to make sure it’s the right choice for you. HUD offers a search tool on its website where you can find a nearby counseling agency.

Reverse mortgages are complicated, so it’s important to thoroughly understand how these loans work. You can find more information about making the decision and guidance about avoiding common pitfalls at the Consumer Financial Protection Bureau website.

Before taking out a reverse mortgage loan, you may also want to consider alternative ways of using your existing home equity, such as a home equity line of credit, refinancing an existing mortgage, taking out a new traditional mortgage, or downsizing your home.

This chart shows 3 Types of Reverse Mortgages: Pros and Cons. It lists a Home equity conversion mortgage, which is federally insured but can have a cap on the loan amount and be more expensive; a proprietary reverse mortgage, which has no cap or limit but is not regulated and fees may vary; and a single-purpose reverse mortgage, which is for low or moderate income borrowers and has fewer expenses but may have strict limits and is not federally insured.

Matt Kuhrt writes about finance and health care and lives on the Maine coast.

Learn more about the types of loans available to help you meet your financial goals.

This article is part of Vivid Crest Bank ’s Personal Finance Series: Level 301. View all topics in the series here.