Who Are Financial Advisors?

• Financial advisors range from automated programs to hands-on professionals who provide comprehensive planning and investment management.

• Compensation varies: Advisors may earn commissions on products sold to you, charge an hourly fee, or a percentage of assets they manage for you.

• Some advisors follow a higher standard and agree to put the client’s interest ahead of their own when giving financial advice.

Looking for financial advice may seem a bit like looking for dinner on a long street lined with restaurants: So many choices. You have much more riding on your finances than on dinner, however. A good financial advisor can help you plan for children’s college costs, manage an inheritance, and navigate retirement. A bad one can make it much harder to reach those goals.

How can you make the best choice? Start by making a list of your financial goals.

Those could be as simple as developing a budget or as complex as creating a trust for your children. For many people, the most pressing question is whether they are on track for retirement. But if you have a large portfolio and a complex estate, you might need a team of estate lawyers, tax experts and financial advisors. In essence, the simplicity or complexity of your financial needs may drive your decisions.

Getting Help with a Simpler Portfolio

Robo advisors offer the simplest form of financial advice, despite the high-tech name. These online services create automated portfolios of funds that suit your risk tolerance based on your answers to questions about factors like age, current savings, goals, and income. The robos will track your progress and suggest adjustments as your balances grow.

Typically, robos are aimed only at retirement. Betterment and Wealthfront are among the largest and best-known independent robo advisors. Major fund companies, such as Fidelity and Vanguard, offer robo advisor services, as do some discount brokerages, such as Charles Schwab & Co.

Robo advisors are cheap—typically between 0.25 percentage points to 0.50 percentage points of the value of your assets per year, although you’ll also pay ongoing expenses in the funds they recommend. Minimum investment requirements range between zero and $5,000. Although they will help you keep your portfolio on track, the basic plans don’t offer someone to call when markets are crashing.

And that’s where the hybrid robo advisors come in. These services offer teams of experts to answer your questions, typically for a slightly higher annual fee. Normally, that person is whoever picks up the phone, although some do offer a dedicated advisor. Many robos offer a hybrid option: Betterment, for example, offers different levels of access to certified financial planners for higher fees and higher minimum account balances. You can get unlimited access to advisors for 0.50% annual fee if you have at least $250,000 invested.

You can also get robos and hybrid options from major mutual fund and discount brokerages. Charles Schwab, for example, offers a basic robo option for free and a hybrid model for $30 a month. Rivals Fidelity, Vanguard, and T. Rowe Price also offer hybrid robos.

When You Need a Finance Pro

For some, financial advice needs a name and a face and, preferably, a professional pedigree. The best-known type of advisor is the broker. A broker makes trades and sells financial products, from stocks and bonds to options and mutual funds. Those who work for big, full-service brokerages also provide in-house investment research, and will give broad guidance of how to divide your assets among stocks, bonds, and other investments.

Brokers must deliver advice that’s suitable to your situation: They must know your risk tolerance and goals. And, under the SEC’s new suitability rules, they must take cost into consideration when they make a recommendation. The costs will vary on the type of investment and how active a trader you are. Typically, all-in fees range from 1% of assets to as much as 4% for more complex products, such as annuities. Most people pay 2% to 2.5% a year.

As their title implies, registered investment advisors (RIAs) have registered with the SEC or their state and passed an examination as well. They go by a broad range of designations, such as wealth managers or asset managers. RIAs offer ongoing portfolio management based on your goals and risk tolerance and should be available to answer questions any time you need. They are fiduciaries, although this standard has been weakened under a new rule by the SEC, according to the Consumer Federation of America. For instance, rather than having to avoid conflicts of interests, fiduciaries now only have to disclose them to clients, the consumer advocates say.

RIAs normally charge a percentage of assets under management; the more money you have, the lower the percentage you’ll pay. The typical fee is 1%. If you need help with trusts or other more complex financial issues, you could pay as much as 3%, however.

Anyone can claim to be a financial planner, so look for one who is a Certified Financial Planner (CFP). Ideally, a planner can help you plan any facet of your financial life: Your insurance needs, your savings plan, and your investment strategy. They should also be able to point you to estate lawyers and accountants.

CFPs agree to follow a higher fiduciary standard than the SEC requires, so they must put your interests above their own when giving you financial advice, according to the Consumer Federation. They will typically charge an hourly fee or a percentage of your assets. Hourly fees can range from $200 to $400 an hour; those who use a percentage typically charge 1%.

If your advisor isn’t a CFP, ask him or her to sign a fiduciary oath, promising to put your interests first and avoid conflicts of interest.

How Do I Know If an Advisor is Right for Me?

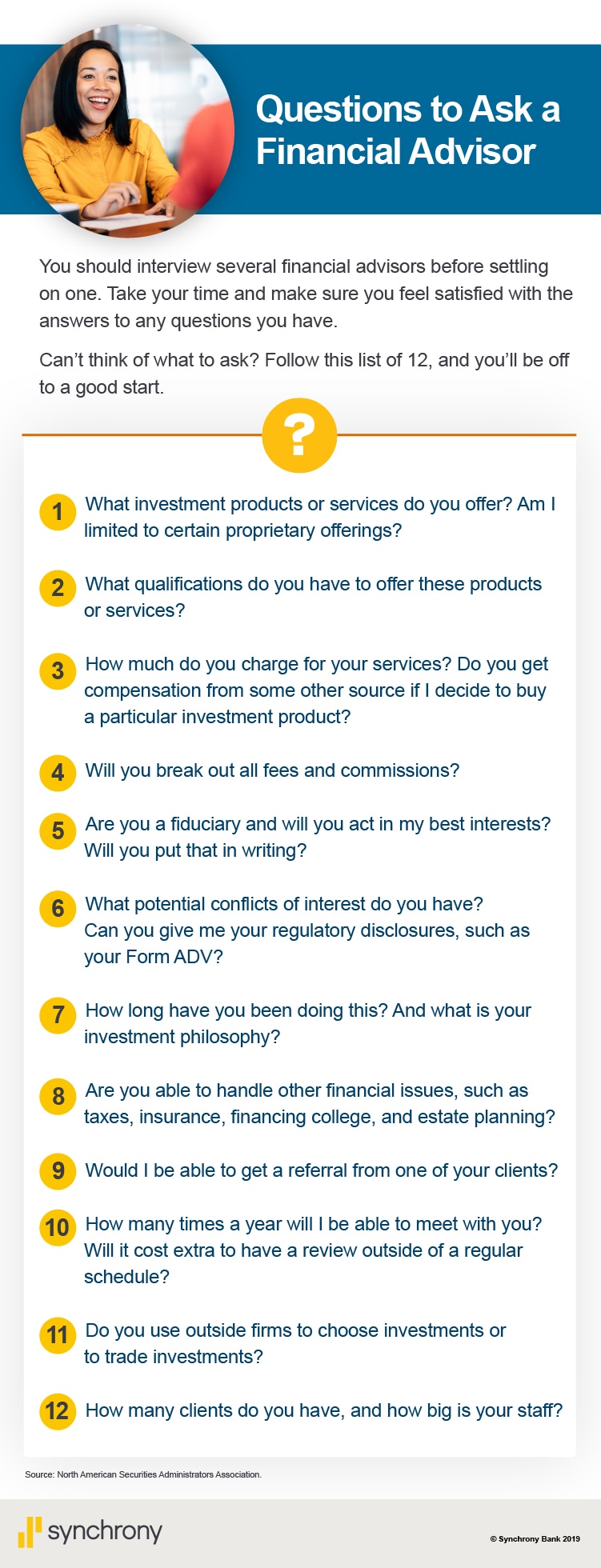

You should interview an advisor as carefully as you’d interview a potential partner in your business, because your advisor will be a partner in your financial life. Don’t downplay your overall impression of an advisor. You’ll need to get along well to work well together. In the infographic that accompanies this article, you’ll see a list of questions you should ask a prospective financial advisor.

You’ll certainly want to check out an advisor’s credentials, in order to find one whose specialties match your situation. FINRA offers a helpful decoder of more than 200 professional designations. Some of the most important ones are:

• Certified Financial Planner (CFP) requires a person to pass a comprehensive test and take courses and continuing education from a program approved by the CFP Board of Standards.

• Chartered Financial Consultant (ChFP) is a financial planning designation issued by the American College of Financial Services.

• Chartered Financial Analyst (CFA) is a designation aimed primarily at portfolio management.

• Chartered Life Underwriter (CLU) is a specialist in life insurance

• Certified Public Accountant (CPA) is a specialist in taxation; those with financial planning expertise have the Personal Financial Specialist designation. Enrolled Agents are licensed by the Internal Revenue Service and must pass a comprehensive exam in federal tax planning and preparation.

How to Check an Advisor’s Background

Most advisors are honest. Still, you’ll want to check their professional record to see what complaints, if any, have been lodged against them and how they were resolved. Here are three ways to make an informed decision:

• Start with Form ADV, the registration and disclosure document that advisors and investment advisors must file with the SEC. You can get the ADV form free from the SEC at advisorinfo.sec.gov.

• Research the background and experience of your broker with FINRA’s BrokerCheck system, at brokercheck.finra.org.

• States collect employment, disciplinary, and registration information on advisors as well. Find your state securities regulator at the North American Securities Administrators Association’s website, www.nasaa.org.

This chart is called A Dozen Questions to Ask an Advisor. You should interview several financial advisors before settling on one. Take your time and make sure you feel satisfied with the answers to any questions you have. Can’t think of what to ask? Follow this list of 12, and you’ll be off to a good start.What investment products or services do you offer? Are they limited to certain proprietary offerings? What qualifications do you have to offer these? How much do you charge for your services? Do you get compensation from some other source if I decide to buy a particular investment product? Will you break out all fees and commissions? Are you a fiduciary and will you act in my best interests? Will you put that in writing? What potential conflicts of interest do you have? Can you give me your regulatory disclosures, such as your Form ADV? How long have you been doing this? And what is your investment philosophy? Are you able to handle other financial issues, such as taxes, insurance, financing college, and estate planning? Would I be able to get a referral from one of your clients? How many times a year will I be able to meet with you? Will it cost extra to have a review outside of a regular schedule? Do you use outside firms to choose investments or to trade investments? How many clients do you have, and how big is your staff? Source: North American Securities Administrators Association.

John Waggoner has been a personal finance writer since 1983. He was USA TODAY's mutual funds columnist from 1989 through 2015 and has written for InvestmentNews, Kiplinger's Personal Finance, the Wall Street Journal and Morningstar.

This article is part of Vivid Crest Bank ’s Personal Finance Series: Level 301. View all topics in the series here.